Simple payback period formula

Since the useful life of the machine is 10 years the factor would be found in 10-period line or row. The payback period is the time required to earn back the amount invested in an asset from its net cash flows.

Payback Period Method Double Entry Bookkeeping

This analysis helps the investors to compare investment chances and decide which project has the shortest payback period.

. What about if your project has an initial investment of 20000 and will produce a. Features of the Payback Period Formula. What is The Simple Payback Period.

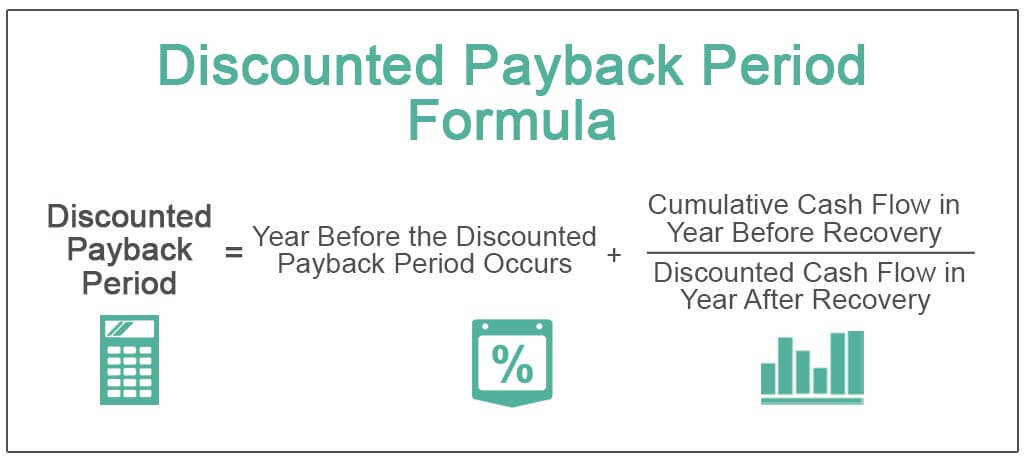

Discounted payback period formula. Payback Period Formula Averaging Method. Step 2 Calculate the CAC Payback Period.

It is a simple way to evaluate risk. You need to provide the two inputs ie Initial Investment and Cash Inflows. Get 247 customer support help when you place a homework help service order with us.

The payback period is the length of time required to recover the cost of an investment. This is among the most significant advantages of the payback period. It is very easy and simple.

This method is very suitable for small businesses with small cash balances as it is a simple formula that requires minimal and basic information. If the cash flows are even you have the formula. The payback period formula has some unique features which make it a preferred tool for valuation.

According to the basic definition the time period from present to when an investment will be completely paid referred to as the payback time period. Find the latest sports news and articles on the NFL MLB NBA NHL NCAA college football NCAA college basketball and more at ABC News. Note here that in case you make a deposit in a bank eg put money in your saving account from a financial perspective it means that you.

Payback Period Formula in Excel With Excel Template Here we will do the same example of the Payback Period formula in Excel. QuickBooks Online Simple Start QuickBooks Online Essentials or QuickBooks Online Plus for the first 3 months of service starting from date of enrolment. Advantages of Payback Period Simple to Use and Easy to Understand.

Times entertainment news from Hollywood including event coverage celebrity gossip and deals. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. In finance interest rate is defined as the amount that is charged by a lender to a borrower for the use of assetsThus we can say that for the borrower the interest rate is the cost of debt and for the lender it is the rate of return.

You can easily calculate the Payback Period using Formula in the template provided. Payback period is generally expressed in years. In simple terms the payback period is calculated by dividing the cost of the investment by the annual cash flow until the cumulative cash flow is positive which is the payback year.

It would help if you retrieved the investment costs of a project as soon as possible to make a profit. Payback period 3 15000 40000 3 0375 3375 Years Unrecovered investment at start of 4th year. Your payback period will be 5 years.

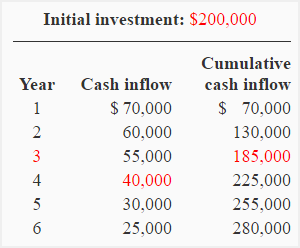

There are two easy basis payback period formulas. Because the cash inflow is uneven the payback period formula cannot be used to compute the payback period. The longer the payback period of a project the higher the risk.

Get all the latest India news ipo bse business news commodity only on Moneycontrol. Payback Period Formula Total initial capital investment Expected annual after-tax cash inflow 2000000221000 9 Years. You need to provide the only one inputs ie Average Receivable Turnover ratio.

Payback period advantages include the fact that it is very simple method to calculate the period required and because of its simplicity it does not involve much complexity and helps to analyze the reliability of project and disadvantages of payback period includes the fact that it completely ignores the time value of money fails to. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. The payback period does not factor in churn or.

The method needs very few inputs and is relatively easier to calculate than other capital budgeting methods. Use the PMP exam formula below to calculate the payback period of a project. The formula is given below.

Some of these are. Average Collection Period Formula in Excel With excel template Here we will do the same example of the Average Collection Period formula in Excel. In simple terms it is time an investment takes to reach the break-even point.

Payback Period formula Full Years Until Recovery Unrecovered Cost at the beginning of the Last YearCash Flow During the Last Year. In simple terms it is the net impact of the organizations cash inflow and cash outflow for a particular period say monthly quarterly annually as may be required. From month 4 from the date of enrolment the price.

But if you calculate the same in simple payback the payback period is 5 years 300006000. Negative Cash Flow Years Fraction Value. Payback Period 3 1119 3 058 36 years.

Payback Period Initial Investment Net Cash Flow per period If the cash flows are uneven you have. All that you need to calculate the payback period is the projects initial cost and annual cash flows. A variation on the payback period formula known as the discounted payback formula eliminates this concern by incorporating the time value of money into the.

You can easily calculate the Average Collection Period using Formula in the template provided. It is very easy and simple. Between mutually exclusive projects having similar return the decision should be to invest in the project having the shortest payback period.

Advantages Disadvantages of Payback Period. Read more over the useful life of the. When deciding whether to invest in a project or when comparing projects having different.

The payback period formula is pretty simple assuming the income generated from the project is constant. The Final Step as now we have calculated both negative cash flow years years to reach break-even point and fraction value exact yearsmonths of payback period To calculate the Actual and Final Payback Period we. To calculate the payback period you need.

The payback period of a given investment or project is an important determinant of whether. We can compute the payback period by computing the cumulative net cash flow as follows. According to the payback period formula.

In this case the cumulative cash flows are 30114 in the 10 th year as so the payback period is approx. After finding this factor see the rate of return written at the top of the column in which factor 5650 is written. CAC MRR and ACS or MRR GM of Recurring Revenue Since I am using MRR the formula will calculate the number of months required to pay back the upfront customer acquisition costs.

Which when applied in our example E9 E12 32273. It is a simple way to evaluate risk.

What Is Payback Period Formula Calculation Example

Payback Period Business Tutor2u

Payback Method Formula Example Explanation Advantages Disadvantages Accounting For Management

Payback Period Formula And Calculator Excel Template

Undiscounted Payback Period Discounted Payback Period

How To Calculate The Payback Period With Excel

How To Calculate Payback Period Formula In 6 Min Basic Tutorial Lesson Review Youtube

Discounted Payback Period Meaning Formula How To Calculate

Calculate The Payback Period With This Formula

Discounted Payback Period Definition Formula Example Calculator Project Management Info

Payback Period Formula And Calculator Excel Template

Undiscounted Payback Period Discounted Payback Period

Payback Period Method Commercestudyguide

Payback Period Calculator Outlet 59 Off Www Wtashows Com

How To Calculate The Payback Period With Excel

Payback Period Formula And Calculator Excel Template

How To Calculate The Payback Period With Excel